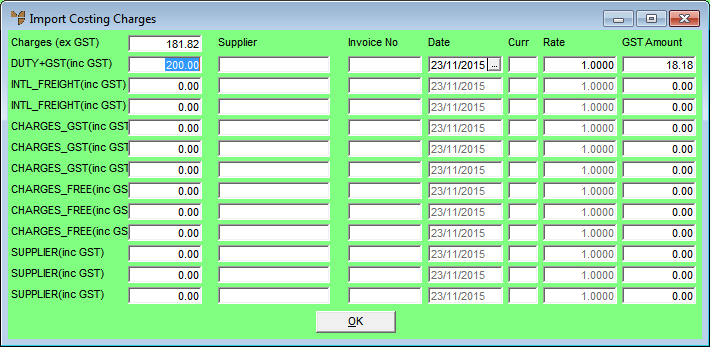

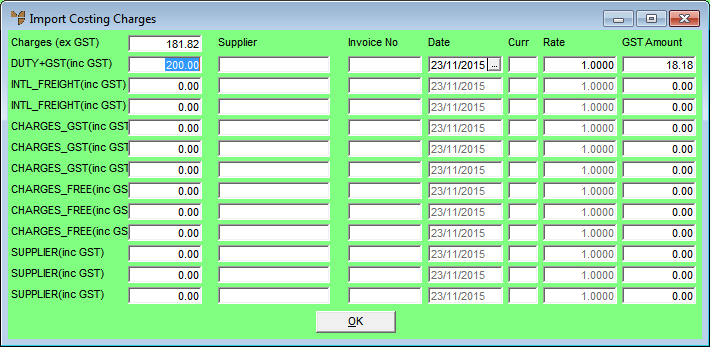

There can be several invoices for import costing charges applicable to a shipment, in addition to a variety of charges that may or may not have GST charged. These charges must be entered according to their tax treatment.

The import costing charges are the individual appropriation amounts which are calculated as the total shipment costs divided by the number of appropriations. For example, $30,000 divided by 3,000 kilograms = $10.00 per kilogram.

Where the duty rate on all imported goods is the same, the duty charges are appropriated using this method, along with all other import costing charges.

To enter the import costing charges:

Refer to "Maintaining the Import Costing Header".

|

|

Field |

Value |

|---|---|---|

|

|

Charges (ex GST) |

Micronet displays the total of the charges for the shipment. |

|

|

[Import Charge] |

Enter the amount (including GST if applicable) for each import cost charge label. For example, if you have setup Duty (inc GST) as an import cost charge label, you would enter the duty charge + GST charge for the goods as charged by Customs. |

|

|

Supplier |

Select a supplier. |

|

|

Invoice No |

Enter the supplier invoice number. |

|

|

Date |

Enter the invoice date. |

|

|

Curr |

Verify the supplier currency displayed. |

|

|

Rate |

Micronet displays the current exchange rate set up in the Exchange Rate master file. You can enter or override this rate if required. |

|

|

GST Amount |

Enter the GST component of any Import Charge amount. Make sure you enter or override the correct GST charge as Micronet calculates one eleventh of the amount entered in this field for an exchange rate of $1.00. Enter 0 if the charge is GST free. |

|

|

|

Technical Tip Make sure you enter the Supplier and Invoice No for the charges. |

Micronet redisplays the Import Costing Header screen.